Ending inventory is the book value of inventory at the end of a financial or accounting reporting period. When you calculate ending inventory it gives you a clear picture of the company’s assets, profit and tax liability. Businesses using inventory management software don’t need to actually calculate ending inventory, since they have a constant view of it, but they will report its level for accounting purposes

The ending inventory of the one financial year, becomes the opening inventory of the subsequent financial year.

Why is Ending Inventory Important?

Closing inventory helps to march recorded inventory with the actual inventory. Knowing your ending inventory verifies the inventory that you have recorded matches the actual physical inventory you have on hand.

Since calculating ending inventory verifies whether the recorded and the actual inventory matches, if If the numbers don’t match up, this could be a sign that you’re paying too much for the initial purchase of goods based on current market value, or that it’s time to rethink your pricing strategy.

Ending inventory ensures accuracy fr future reports as a given accounting period’s beginning inventory is calculated from the previous period’s ending inventory.

Factors Affecting Closing Inventory.

Beginning Inventory: This is the inventory that is held at the start of any accounting period.

Purchases: The cost of the goods that were bought in the time period. This may be determined from the income statement under expenses and includes both the direct and indirect costs.

Sales: The money received through sales as recorded on the income statement.

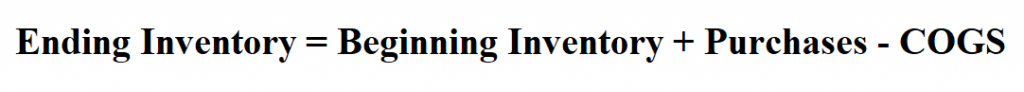

Formula to Calculate Closing Inventory.

Beginning inventory is monetary values that a company assigns to their current inventory.

Purchases are new inventory that was purchased during the current accounting period.

COGS this is the cost of goods sold.

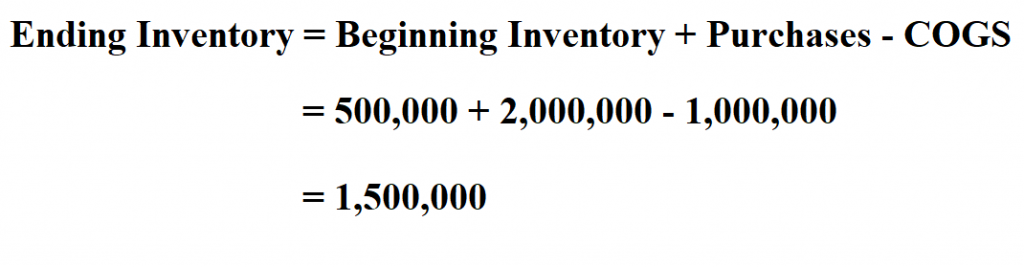

Example:

The total beginning inventory of a firm for a certain financial period was worth $ 500,000. The total purchases for that year was $ 2,000,000 and the value of the cost of goods sold was $ 1,000,000.

Therefore, the ending inventory of the firm was $ 1,500,000.

There are other methods that can also be used to calculate ending inventory. They include:

- FIFO method (first in, first out)

- LIFO method (last in, first out)

- Weighted average method