Accounting profit is a company’s total earnings, calculated according to generally accepted accounting principles.

Unlike economic profits, accounting profits does not include opportunity costs.

Accounting profit can be utilized to determine a company’s taxable income for purposes of loan considerations, interest calculations, growth estimates and internal budget considerations.

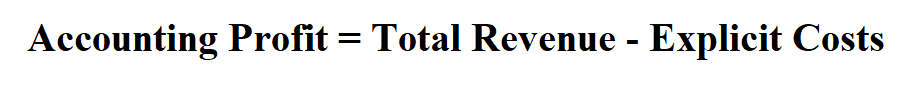

Formula to calculate accounting profit.

Explicit costs include Material cost, Labor cost, Production & overhead cost, transportation cost, sales and marketing cost, etc.

Total revenue refers to the total receipts from sales of a given quantity of goods or services.

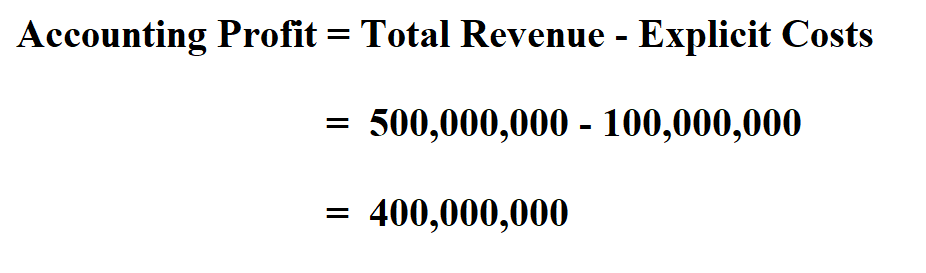

Example:

If a company’s total revenue’s value is $ 500million and the total cost of the explicit costs is $ 100million. Determine the accounting profit of the company.

Therefore, the accounting profit of the company is $ 400 million.