What is Time and a Half?

Ahead of discussing how to calculate time and a half, let us begin by defining and then discuss what it entails. Time and a half refers to an extra 50% on top of an employee’s standard hourly wage for every hour an employee works in addition to the standard 40-hour working week.

This concept is used to calculate the overtime pay.

Unfortunately, not all employees receive overtime pay. An employee’s ability to receive time and a half depends on whether they are exempt or nonexempt.

Differences Between Exempt and Nonexempt Workers.

Exempt Workers.

We say an employee is exempt if;

- They make at least $35,568 annually.

- Receive a salary.

- Have job duties that are considered exempt. These job duties include high-level responsibilities that directly affect the company’s overall operations, such as executive, administrative, professional, or computer-based duties.

- Additionally, if you pay an employee an annual salary of $107,432 or more, they are exempt if they have at least one executive, administrative, or professional job duty.

- If an employee’s primary duty is making sales, they are exempt. The employee must also regularly perform work away from your business and they do not have to meet salary exemption requirements to be exempt.

Non-exempt Employees.

We say an employee is non-exempt if;

- They do not make at least $35,568 annually.

- They are usually hourly employees.

- They do not have exempt job duties like administrative duties.

There’s a common misconception that paying an employee a salary means they’re exempt from overtime wages. You can have salaried nonexempt employees who are eligible for overtime pay.

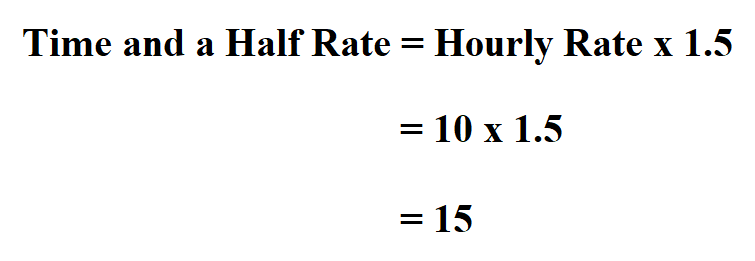

Formula to Calculate Time and a Half.

How you calculate overtime pay, however, differs between the hourly and salaried workers on your team.

Overtime pay for Hourly Workers.

Example:

An employee in Company A earns $10 hourly during a 40-hour work week. Determine her time and a half hourly rate.

Therefore, her time and a half hourly rate is $15.

Overtime Pay for Salaried Workers.

- Determine the regular hourly pay rate by dividing the weekly salary by the fixed number of hours

- Calculate the payment for a 40-hour workweek

- Find out the overtime pay rate by multiplying the regular pay rate by time and a half

- Calculate the overtime pay by multiplying the overtime pay rate by the number of overtime hours for a particular week

- Add the overtime pay to the 40-hour workweek payment.

Example 2:

Suppose Jungkook gets a weekly salary of $720 for 36 hours of work. However, last week he worked for 42 hours instead.

His regular hourly pay rate is:

$720/36 hours = $20 per hour

This means that for a 40-hour workweek, his pay is:

40 hours x $20 = $800

His overtime pay rate is:

$20 x 1.5 = $30

Hence, Jungkook’s overtime pay for the week will be;

2 hours x $30 = $60