What is Operating Cash Flow?

In this article, we are going to discuss how to calculate operating cash flow but before that, lets define cash flow. Cash flow is the amount of cash or cash-equivalent which the company receives or gives out by the way of payment to creditors.

While operating cash flow (OCF) is a measure of the amount of cash generated by a company’s normal business operations within a specific time period. OCF begins with net income adds back any non-cash items, and adjusts for changes in net working capital, to arrive at the total cash generated or consumed in the period.

Importance of OCF.

- Operating cash flow is important because it provides the analyst insight into the health of the core business or operations of the company.

- When assessing potential borrowers, financial institutions consider the likelihood of getting their money back. Businesses with a favorable OCF can boost their chances of loan approval.

- Investors want to put their capital towards something that will grow and make them a lot of money. A healthy OCF will instill confidence in investors and proof of your ability to generate an ROI on their investment.

Without a positive cash flow from operations a company cannot remain solvent in the long run.

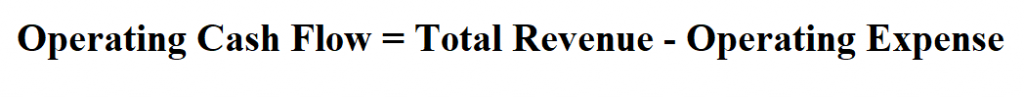

Formula to Calculate Operating Cash Flow.

There are two methods used to calculate OCF. They are;

- Direct Method

- Indirect Method

Direct Method

In the direct method, the company records all transactions on a cash basis and displays the information using actual cash inflows and outflows during the accounting period. However, it only accounts for cash revenues and expenses. It is calculated with the formula:

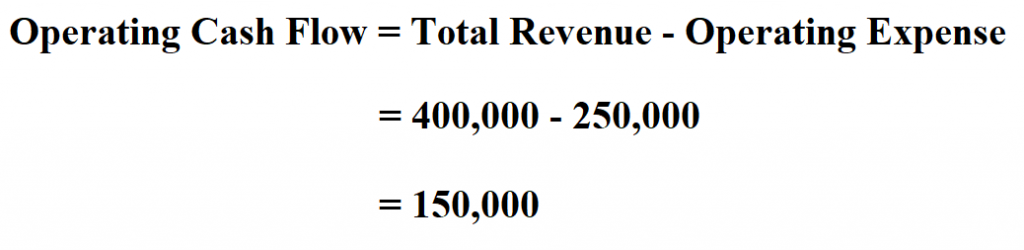

Example 1:

Suppose a company’s total revenue is $400,000 and its operating expense cost is $ 250,000. Calculate the company’s OCF.

Therefore, the company’s operating cash flow is $ 150,000.

Indirect Method

To calculate operating cash flow under the indirect method, subtract all depreciation, amortization, income taxes, and finance-related income and expenses from the reported net income of a business.

Conversely, it can also be calculated by subtracting all operating expenses ,less depreciation and amortization, from revenues. Depreciation and amortization are subtracted because they are non-cash expenses.

Example 2:

Consider a manufacturing company that reports a net income of $500 million, while its operating cash flow is $450 million. The difference results from a depreciation expense of $150 million, an increase in accounts receivable of $100 million, and a decrease in accounts payable of $100 million. It would appear on the operating cash flow section of the cash flow statement in this manner:

| Net Income Depreciation Increase in AR Decrease in AP Operating Cash Flow | $500 Add back $150 Less $100 Less $100 $450 |

The method chosen depends on which information is more readily available.